Something happened to the markets around Valentine’s Day which could reverse the recent uptrend.

The stock market didn’t like what it saw in the bond market last week, as yields steadily rose in response to warmer-than-expected readings in both consume price index (CPI) and producer price index (PPI) followed by increasingly hawkish talk from the Fed. At the same time, other indicators suggested that risk of a recession is still there. Buried in all the noise, however, was a significant, sudden, and troubling decrease in liquidity, which I will discuss fully in the following sections.

That means we have two plausible scenarios for stocks now. One is a consolidation pattern; the other is a full-blown correction. At this point, given the distortion introduced into the market’s price action by options expiration week, it’s a tough call. That means that what happens in the next few days will offer more information.

If the market enters a lengthy consolidation pattern, it would mean that we’re back in a stock picker’s market. If a full blown correction develops, I would expect the selling to pick up quickly, which means that hedging of portfolios will be in order.

Just in case, I’ve just added some select hedges to my model portfolios. You can check them out here with a free trial to my service.

Ripples in the Trend

Last week in this space, I noted that trading algorithms (bots, algos) follow three basic rules when allocating their resources based on the simple principle “if this happens, do this.” Specifically:

Market maker bots react to the order flow;Order flow depends on liquidity;Commodity-trading advisor algos react to support and resistance levels.

This combination of rule-following by both major groups of algos creates the price trend at any one time. Moreover, uptrends are based on adequate liquidity; when liquidity dries up, so do the odds of a rising market rise.

Here’s how it works. Order flow is what the market-maker bots see before every trade gets executed; a preponderance of buyers or sellers. Over time, the order flow becomes a trend that’s magnified by what non-market-maker bots do based on price behavior at key support or resistance levels in the market.

A third and equally important component of the market’s trend is the hedging that’s put in place by market maker algos to protect their accounts. During periods in which sell orders outnumber buy orders, market maker algos lower bid/ask prices by executing lower-priced trades. Meanwhile, they sell put options to bearish traders and sell stock index futures to hedge their own accounts. This combination of orders from traders and market makers serves to drive prices lower.

The reverse is true when buy orders outnumber sell orders. In this case, as they sell stocks to buyers, they hedge their risk by selling call options and buying stock index futures. This causes the market to go up.

In the current market, we’ve seen a shift in the market from a bullish tone to a slightly bearish tone. Therefore, it’s safe to assume that the market maker algos have noted a shift in the order flow, from bullish to bearish, and are acting accordingly.

What that translates to from a trading standpoint is that the market’s trend is slowly changing. I have full details below.

Bond Yields Explode as Liquidity Dries Up. Homebuilders Sneeze.

Steady selling has hit the U.S. 10-Year note ($TNX), sending its yield above 3.8%. A move above 4% would be a major negative for stocks, which could trigger aggressive selling.

Moreover, the rise in yields has triggered a rise in mortgage rates, which threatens to hamper the recent bounce in home sales.

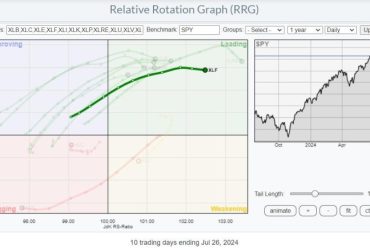

The upshot is that the homebuilder sector, as in the SPDR S&P 500 Homebuilders ETF (XHB), is now testing the support of its 20-day moving average.

Perhaps the most concerning aspect that has contributed to what may become a major reversal in stocks is the sudden decline in liquidity. You can see that expressed in the sudden downturn in the Eurodollar Index ($XED) and its full effect in detail below.

What’s most interesting about this liquidity reduction is that the Fed is only scheduled to remove $150 million from the system over the next month. Certainly the most recent QT started on February 14, 2023, just about the time the $XED began to roll over. It’s hard to quantify how a potential $150 million liquidity drain could lead to such a market hiccup; unless, of course, it’s the Fed that’s been selling T-bonds aggressively outside of the announced program to reduce economic activity.

Another plausible explanation is that a major player, perhaps one of several commercial property REITs that is having problems with foreclosures, has been selling bonds. Aside from Brookfield’s LA default, Blackstone (BSX) is also having its share of problems, as is Starwood (STWD).

If the second scenario is closer to the truth, then we may be closer to a more significant liquidity crisis as the contagion spreads.

Since homebuilders have been a huge component of the rally since the October 2022 bottom, persistent weakness in the group would likely add to the general market’s weakness.

Market Reverses as Liquidity Crashes

The New York Stock Exchange Advance Decline line ($NYAD) broke below its 20-day moving average support and may move lower. The next support is at the 50-day moving average.

Meanwhile, the S&P 500 index ($SPX) fell further below 4100 and below its 20-day moving average. The index is and is now testing the 4050 area. There’s a hefty and important support area just below where three large volume-by-price (VBP) bars (big bars on the left of the chart) were previous resistance levels as the market arose.

If $SPX breaks below this support area, where the bottom is near the 3950 and the 200-day moving average, the uptrend will have been vanquished. On the other hand, if the market is able to hold somewhere inside that broad band and eventually move above 4200, the bulls would be back in business.

The Nasdaq 100 Index ($NDX) remained above its recent support at the 12,200 area, but ended the week straddling its 20-day moving average, which means the uptrend remains intact, although it’s a bit bruised. There’s a strong VBP support band between 11750 and 12250. A move below the 200-day moving average would be very negative.

For its part, the Cboe Volatility Index ($VIX) is showing signs that it wants to turn up. It has remained above 20, but still has resistance at 22.50. When VIX rises, stocks tend to fall, as rising put volume is a sign that market makers are selling stock index futures in order to hedge their put sales to the public. A fall in VIX is bullish, as it means less put option buying, and it eventually leads to call buying, which causes market makers to hedge by buying stock index futures, raising the odds of higher stock prices.

Liquidity unfortunately reversed last week as the Eurodollar Index ($XED) closed below 95, which had been a reliable support level. Note the market’s most recent rally, off the October bottom, has corresponded to this flattening out in liquidity. Also note how the continuous decline in $XED corresponded to the bear trend in 2022 and how the current liquidity reduction has impacted the market negatively.

You can learn more about how to gauge the market’s liquidity in this Your Daily Five video.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition—Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader, and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best-selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.