The stock market suddenly has the look of a wounded prize fighter. And the bond market is bordering on being dysfunctional. In a word, the market is disoriented. Disorientation leads to mistakes.

Don’t be fooled. From an investment standpoint, this is one of those periods where those who stay vigilant and pay attention to developments will be in better shape than those who remain confused by circumstances.

As I noted last week: “The relationship between interest rates and stocks is about to be tested, perhaps in a big way. Observe the tightening of the volatility bands (Bollinger Bands) around the New York Stock Exchange Advance Decline line ($NYAD) and the major indexes. This type of technical development reliably predicts big moves. The real arbiter may be the US Treasury bond market. And the place where a lot of the action may take place once bonds decide what to do next may be the large-cap tech stocks. Think QQQ.”

Yeah, buddy!

Bond Yields Trade Outside Normal Megatrend Boundaries

Big things are happening in the bond market, which could have lasting effects on stocks and the US economy.

I’ve been expecting a big move in bond yields, noting recently that yields on the 10-Year US Treasury Yield Index ($TNX) were “on the verge of breaking above long-term resistance,” while adding that if such a move took place, it “would likely be meaningful for all markets; stocks, commodities, and currencies.”

Well, it happened; after the FOMC meeting and Powell’s post-mortem (uh, press conference), TNX blew out all expectations and broke above the 4.4% yield area in a big way, marking their highest point since 2007. It was such a big move that it may be an intermediate-term top. At one point in overnight trading on September 21, 2023, TNX hit the 4.5% level. But the current selling in bonds is way overdone, which means that at least a temporary drop in yields is on the cards.

Here’s what I mean. The price chart above portrays the relationship between TNX and its 200-day moving average and its corresponding Bollinger Bands. As I noted in my recent video on Bollinger Bands, this is a crucial indicator for pointing out trends that have gone too far and are ripe for a reversal.

In this case, TNX blew out above the upper Bollinger Band, which is two standard deviations above the 200-day moving average. That move is the magnitude of a Category 5 hurricane on steroids and amphetamines. It’s also unlikely to remain in place for long unless the market is completely broken.

The price chart suggests we may see a similar situation to what we saw in October 2022 when TNX made a similar move before delivering a nifty fall in yields, which also marked the bottom for stocks.

Meanwhile, as described below, the S&P 500 ($SPX) is reaching oversold levels not seen since the October 2022 and the March 2023 market bottoms.

Stay awake.

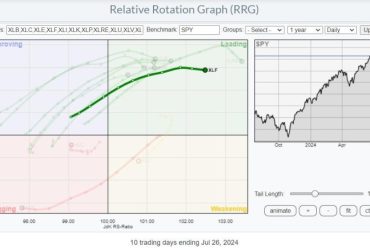

Oil Holds Up Better Than QQQ For Now

A great way to regroup after a tough trading period is to first look for areas of the market that are exhibiting relative strength. Currently, the oil sector fits the bill. Second, it pays to look for beaten-up sectors where recoveries are happening the fastest. At this point, it’s still early for that part of the equation to develop, as too many traders are still shell-shocked.

Starting with a look at West Texas Intermediate Crude ($WTIC), prices are holding above $90 as the supply for diesel and fuel is well below the five-year average. And yes, U.S. oil supplies continue to tighten while the weekly rig count falls.

The NYSE Oil Index ($XOI), home to the big oil companies such as Chevron Texaco (CVX), had a mild reaction to the heavy selling we saw in the rest of the market. XOI looks set to test its 50-day simple moving average in what looks to be a short-term pullback.

Chevron’s shares barely budged earlier in the week despite an ongoing, albeit short-lived strike by natural gas workers at its Australian facilities. That’s a strong showing of relative strength. You can see that short sellers are trying to knock the stock down (falling Accumulation/Distribution line), but buyers are not budging as the On Balance Volume (OBV) line is holding steady.

On the other hand, the very popular trading vehicle the Invesco QQQ Trust (QQQ) broke below the key support level offered by the $370 price point and its 20 and 50-day simple moving averages. This is an area that I highlighted here last week as being critical support. It now faces a test of the support area at $355. A break below that would likely take QQQ and the rest of the market lower.

An encouraging development is that the RSI for QQQ is nearing 30, which means it’s oversold. Let’s see what happens next. You can also see a similar pattern in the ADI/OBV indicators to what’s evident in CVX above, which suggests that when the shorts get squeezed, it could be an impressive move up.

Join the smart money at Joe Duarte in the Money Options.com. You can have a look at my latest recommendations FREE with a two-week trial subscription.

And for frequent updates on the technicals for the big stocks in QQQ, click here.

The Market’s Breadth Breaks Down and Heads to Oversold Territory

The NYSE Advance Decline line ($NYAD) finally broke below its 20 and 50-day simple moving averages and is headed toward an oversold reading on the RSI, which is approaching the 30 area.

The Nasdaq 100 Index ($NDX) followed and is not testing the 14500–14750 support area. ADI is falling, but OBV is holding up, which means we will likely see a clash between short sellers and buyers at some point in the future.

The S&P 500 ($SPX) is in deeper trouble as it has broken below the key support at 4350 and its 20 and 50-day moving averages. On the other hand, SPX closed below its lower Bollinger Band on September 22, 2023, and is nearing an oversold level on RSI. Still, the selling pressure was solid as ADI and OBV broke down.

VIX Remains Below 20

The Cboe Volatility Index ($VIX) is still below the 20 area but is rising. A move above 20 would be very negative.

When VIX rises, stocks tend to fall as it signifies that traders are buying puts. Rising put volume is a sign that market makers are selling stock index futures in order to hedge their put sales to the public. A fall in VIX is bullish as it means less put option buying, and it eventually leads to call buying, which causes market makers to hedge by buying stock index futures, raising the odds of higher stock prices.

Liquidity is Tightening Some

Liquidity is tightening. The Secured Overnight Financing Rate (SOFR) is an approximate sign of the market’s liquidity. It remains near its recent high in response to the Fed’s move and the rise in bond yields. A move below 5 would be bullish. A move above 5.5% would signal that monetary conditions are tightening beyond the Fed’s intentions. That would be very bearish.

To get the latest information on options trading, check out Options Trading for Dummies, now in its 4th Edition—Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader, and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best-selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.