A top official with the DOJ Tax Division told the House Judiciary Committee that now-Special Counsel David Weiss needed approval from his unit at the Justice Department before bringing charges in the Hunter Biden probe, according to a transcript of his interview reviewed by Fox News Digital.

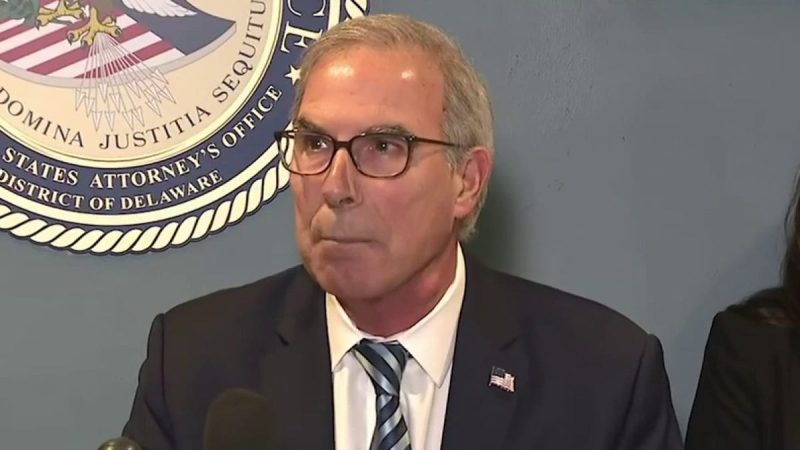

Acting Deputy Assistant Attorney General for the DOJ Tax Division Stuart Goldberg participated in a transcribed interview before the House Judiciary Committee last week as part of the panel’s investigation into whistleblower allegations that politics impacted prosecutorial decisions throughout the years-long federal investigation into the president’s son.

Goldberg’s testimony on the issue appears to confirm testimony from IRS whistleblowers who said that Weiss did not have ultimate authority in bringing charges in the Hunter Biden case.

Goldberg told committee investigators that Weiss, who before being granted special counsel status served as the U.S. attorney for Delaware, had to get approval from the Tax Division within theDepartment of Justice before bringing charges.

‘We have approval authority, though some can appeal us if they disagree, but yes, it’s our responsibility in the first instance to do that,’ Goldberg testified.

Goldberg was asked: ‘If felony tax charges are going to be brought, the Tax Division has to sign off? Has to okay it?’

Goldberg said, ‘Yes.’

‘In a typical case, yes, we would have to okay that,’ he said. ‘But if somebody thought we should have okayed it, and we didn’t, then they could appeal, but, yes, it’s our responsibility.’

When asked whether Weiss had been granted ‘special attorney status or special counsel status,’ and whether he still would be required to ‘go through the Tax Division to get approval of the tax charges,’ Goldberg said, ‘Yes.’

‘Generally speaking, we approve specific charges,’ he said. ‘But we might provide an option, I guess.’

Goldberg added: ‘In some tax cases, the Tax Division might say, ‘U.S. Attorney, you have discretion to bring this charge or this other charge.’’

‘Sometimes cases get sent back for more work. So that is an option,’ he said. ‘And there is declination, approval or prosecution with discretion or prosecution authorized.’

Goldberg explained that in ‘approval prosecution authorization, there is an expectation the case would be brought by the U.S. Attorney’s Office.’

‘If it is prosecution with discretion, then the U.S. Attorney’s Office has the ability to decide not to bring the case,’ he said. ‘That is within their purview. They don’t have to come back to the Tax Division.’

IRS Whistleblower Gary Shapley said that Weiss did not have charging authority and was ‘constantly hamstrung, limited and marginalized’ by DOJ officials as he sought to make prosecutorial decisions. Shapley also alleged that Weiss had requested special counsel authority but had been denied. He has since been appointed special counsel.

Meanwhile, Goldberg was asked whether the DOJ’s Tax sign-off was necessary due to Hunter Biden’s involvement.

‘Well, without getting into the case, again trying to answer a question at a slightly higher level, there are cases that are sensitive, people—some would say sensitive, sometimes say significant cases,’ he explained. ‘And those cases typically have a closer supervision than other, more run-of-the-mill cases.’

Goldberg was also pressed on whether the target having ‘some political significance attached to him or her’ would ‘trigger any heightened review process.’

‘If something can be termed as sensitive pursuant to the case, it might be because it’s a public official, or it’s a person that has a noteworthy profile, or it’s going to generate a lot of media attention, or might be of congressional interest,’ He explained. ‘It could be a corporation or an individual.’

‘That might mean that the case would come to my level for ultimate sign-off on the case as opposed to be handled at the chief’s level,’ he said.

When asked whether it was ‘fair to say that the Hunter Biden case fell into that category,’ Goldberg said, ‘Yes.’

Weiss charged Hunter Biden last month with making a false statement in the purchase of a firearm, making a false statement related to information required to be kept by a federal firearms licensed dealer and one count of possession of a firearm by a person who is an unlawful user of or addicted to a controlled substance.

The president’s son pleaded not guilty to all charges.