Indices Analysis Summary

Continuing from the previous article, the analysis of the various rankings for the indices shows that the data in the table is robust and accurate. In summary, there are two types of overall trendiness measures; Trendiness One uses all of the data to determine trendiness, and Trendless uses only the trending data determined by the filtered wave value and the trend length. Of course, Trendiness One is the complement of Trendless analysis. They are still measuring trendiness, just in two different arenas. There are also two measures of Up Trendiness using the same concept.

This could have just as easily been a ranking of down trendiness, but I think up trendiness is more prevalent in most markets.

Appendix B contains a number of tables that show the tables ordered by their ranks, which makes it easier to find the ranking you are looking for. The following tables show various subsets of the All table just analyzed.

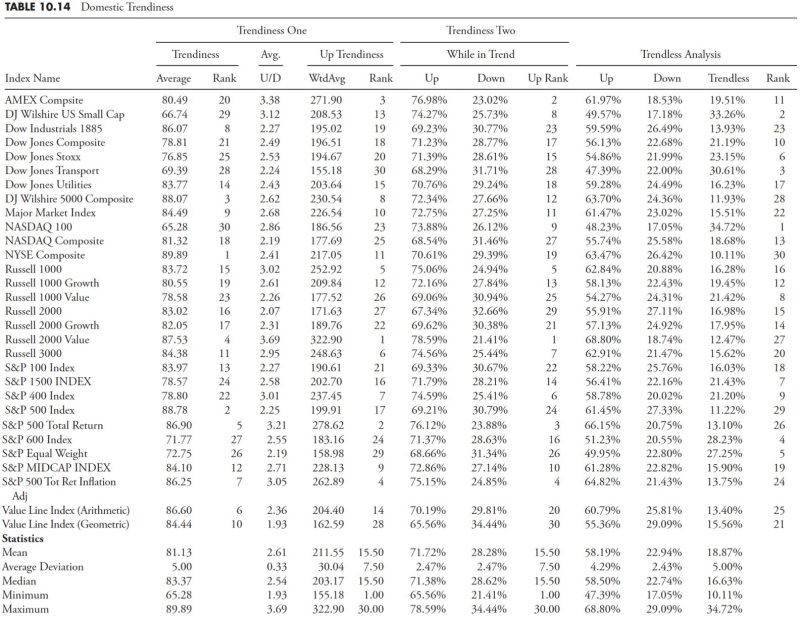

Domestic Trendiness

Table 10.14 contains only the domestic issues.

International Trendiness

Table 10.15 contains only the international issues.

Commodity Trendiness

Table 10.16 contains only the commodity-based issues.

Sector Trendiness

Table 10.17 contains only the sector-related issues.

Data with History Prior to 2000

Table 10.18 contains all the issues that have data that began prior to 2000. This table contains more issues than the following two tables, as each of them reduces the number of issues by increasing the amount of data by using an earlier starting date.

Data with History Prior to 1990

Table 10.19 contains all the issues that have data that began prior to 1990.

Data with History Prior to 1980

Table 10.20 contains all the issues that have data that began prior to 1980. This is the table with the longest set of data and hence, the fewest number of issues.

Trend Analysis on the S&P GICS Data

Next, I’ll conduct a similar study on the 95 S&P GICS Sectors, Industry Groups, and Industries. This is a different study in that the parameters for determination of trending markets were greatly expanded. The number of days for trend determination was tabulated for days from 15 to 65. The filtered wave percentage was also expanded from 5% to 11%. All of the analysis that was included in the previous section was done on these 95 sectors and industry groups.

The Global Industry Classification Standard (GICS) is an industry taxonomy developed by MSCI and Standard & Poor’s (S&P) for use by the global financial community. The GICS structure consists of 10 sectors, 24 industry groups, 68 industries, and 154 subindustries into which S&P has categorized all major public companies. The system is similar to ICB (Industry Classification Benchmark), a classification structure maintained by Dow Jones Indexes and FTSE Group.

S&P Sectors, Industry Groups, and Industries

The numerical identification is exactly the same used by Standard & Poor’s in their GICS classification methodology. Most, but not all, of the GICS database began in 1989; in fact, there were only 21 series that did not begin in 1989. When viewing the analysis that follows, you can cross-reference this table if one particular sector or industry seems to trend outside the average, then check the start date as it might not have enough data for good analysis. Table 10.21 shows all the GICS data and each starting date.

GICS Total Summary

Table 10.22 shows the robustness of the analysis. It is entirely too much data to put into a table in a book, but is displayed here merely as proof (only partial data is shown). The raw data will be removed for the remainder of this analysis, only showing the average rankings and relative rankings. This is a table that shows the total trend (up and down) for all the raw data used in the analysis, with filtered waves from 5% to 11% and trend lengths from 15 to 65 days. The table is presented here just to give you an idea as to how much analysis went into this. A summary table follows that is much easier to view.

The GICS Summary tables are shown below, but without the vast amount of raw data — only the name of the classification, the average of all the raw calculations, and the relative rank of each. Following these tables are tables using the same analysis that was conducted previously on the 109 indices.

GICS Summary

Table 10.23 contains all of the averages of the various filtered wave and trend days analysis categorized into Total Trendiness, Uptrends, Downtrends, and the ratio of up to downtrends. You will notice that there are missing data in the U/D Ratio column. This is because of a couple of different things.

There were a few of the series that just did not have a long enough data history.

When you mix a small filtered wave with a long trend expectation, you will find that some series just do not have an Uptrend, a Downtrend, or both. Division does not work well with a zero for numerator or denominator.

On first glance at the above table of all GICS issues, it could be noticed that all of the ones that have numerical codes starting with the number 3 are ranked high in the Total Trendiness. While I think this is poor analysis, let’s see if there is anything there.

Oh my, yes there is — all of them are part of Consumer Staples or Healthcare. Both of these sectors are typically defensive in nature and usually with less volatility. If you refer to the table at the beginning of this section that has 109 market indices, it also contains 16 sectors or industries. Consumer Staples is ranked in that table using Trendiness One as number 3, while the Healthcare sector is ranked number 14. Remember that these are relative ranks, but the results confirm that Staples and Healthcare are good trending issues.

Does this hold up for other defensive issues such as Utilities and Telecom? The Utilities sector and the Electric Utilities industry rank 14 and 13 in overall trendiness; however, the other utility industries do not rank high. Telecom sector ranks 23, with diversified telecom industry at 25 and wireless at 89. It should also be noted, when doing this type of analysis, that the wireless data begins 4 years later than the other, but I don’t see that as a hindrance.

GICS Summary Table (With Inadequate Periods of Analysis Removed)

Let’s now look at which GICS issues are not good at trending (Table 10.24). The top five are Internet Software and Services, Internet and Catalog Retail, Health Care Technology, Office Electronics, and Construction Materials. With this wide dispersion of industries, let’s first check the data. First note that of the 95 GICS issues, only 20 (21 percent) have data less than the majority, which all begin in 1989. Four of the poor trending issues are in this category. Only Construction Materials began in 1989. Since this analysis is measuring relative trendiness, one would then need to go to each individual issue and chart it as was done in the previous section.

GICS Table for All Trends Up to and Including 30 Days

Table 10.25 shows the analysis on the GICS data in the same manner as the earlier analysis on the 109 market indices. A review of the details in that section might be helpful.

Trend Analysis in Secular Bear Markets

Table 10.26 shows the trend analysis for the periods when the Dow Industrials was in a secular bear market. Although these results are not as robust as the research in this chapter, and uses the 21-day trend without a move of more than 5% as the measure, it does show, by example, the message. Without studying the markets, one might assume that secular bear markets are mainly downtrending markets. Hopefully this table dispels that notion and shows that, during secular bear markets, a strong tendency to trend still exists.

If there is a single takeaway from all this analysis on market trends, it is this: markets trend. Herding causes demand, which is the opposite of economic supply and demand. The stock market is a demand event. Some issues trend better when in uptrends than in downtrends, while the reverse holds true for some. From the tables in this chapter and in the appendix, you should be able to discern which indices, sectors, or industries are better for trending.