Earnings season is kicking off and Carl and Erin spotlight the banks that will be reporting on Friday. The setups aren’t good for all of these banks, but some are set up nicely going into their earnings calls. Earnings are always tricky as good earnings can still result in losses, but the technicals suggest these banks are ready to run higher.

Carl gives us his view of the market in general as well as Bitcoin, the Dollar, Gold, Yields and Bonds among others. He also leads us into the earnings discussion with a review of his SPX earnings charts. Finally, he covers the Magnificent Seven stocks.

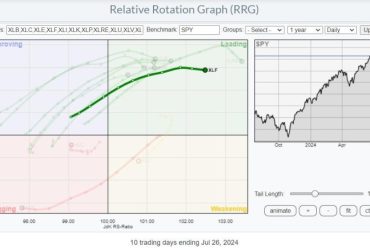

Erin starts off her portion of the show with a review of sector rotation with special emphasis on Financials. She shows us the “under the hood” chart for Regional Banks (KRE) which isn’t set up as well as it needs to be going into earnings.

To end the show Erin looks at viewers symbol requests with an eye toward both the short and intermediate terms.

01:10 DecisionPoint Scoreboards

03:55 Market Overview

12:23 SPX Earnings Discussion

15:26 Magnificent Seven

18:07 Sector Rotation

23:47 Financials & Banks

31:05 Symbol Requests

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)