In the Bible story, David and Goliath represent resilience and overcoming odds. David, a small sheepherder, places a stone in a sling to hurl at Goliath’s head. David gets a clean hit and Goliath falls. David then uses Goliath’s sword to kill and decapitate the giant.

If we look at the small caps and the large caps as seen through the lens of IWM and QQQ, it certainly has similarities to the parable.

Small caps, like David, have had to overcome odds to show resilience. In October 2022, both IWM and QQQs bottomed out. Then, in February 2023, it almost looked like the small caps were ripe to take out the 23-month moving average in blue (or about a 2-year business cycle)… until the commercial bank crisis.

If you are new to the Dailys, I have written extensively on the 2-year cycle as key this year, given the bull run of 2021 and the bear run of 2022. This year, we knew could be pivotal. But is it really?

Once the small caps fell from the key resistance, Goliath woke up. Large caps began to rally, departing from the weakness of the small caps. QQQs kept going and, by May, cleared the 23-month, and off it went. Meanwhile, IWM struggled to hang on to the 80-month or about the 6-to-8-year business cycle low. Except for the COVID crash, IWM has been above the 6-8 year low for over a decade. In fact, we avoided the recession from a technical perspective as not only did that business cycle low hold, but in June the IWM began to run up as well.

Anyway, back to our story. It seemed that, this past week, small caps were once again ripe to run. Of course, NASDAQ has not stopped. After all, technology, according to market sentiment is the savior of everything… but is it really?

Here is where David v. Goliath comes in. Small caps once again ran right to the 23-month moving average and closed the week below it. Now, it may clear it later on this month. If IWM does clear, we think that will take some thunder from the large caps with another rotation to value, but not necessarily the final blow for QQQs. However, if IWM cannot clear, then we can begin to speculate that David has slung the rock at NASDAQ’s giant head. Only this time, they both may fall.

Why might IWM not clear the 23-month MA? Inflation, Fed hikes, bonds back in vogue, poor earnings, consumers cutting back??? Take your pick. It is though, too soon to tell.

But let’s end with a potential stone.

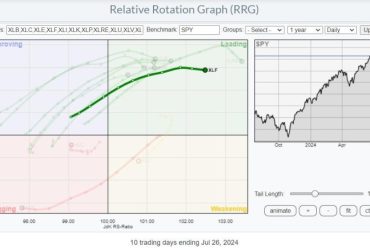

Consumer Staples (XLP).

As this just cleared the 50-daily moving average, a move over 75.00 could indeed signal that the consumer is shifting away from toys, and more towards things they really need.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish talks her approach to being a professional trader in this Options Insight interview with Imran Lakha.

Nicole Petallides and Mish discuss crypto, basic materials, inflation and gold in this appearance on TD Ameritrade.

Mish and Ash Bennington cover a lot in this video from Real Vision, discussing everything from the Fed, to inflation, to the incredible move in stocks and what is next.

Mish talks day-trading tactics, currency pairs, gold, oil, and sugar futures in this video from CMC Markets.

Mish and Angie Miles talk tech, small caps and one new stock in this appearance on Business First AM.

Mish examines the old adage “Don’t Fight the Fed” in this interview on Business First AM.

Mish and Charles Payne talk the Fed, CPI, Inflation, yields, bonds and sectors she likes on Fox Business’ Making Money with Charles Payne.

Mish, Brad Smith and Diane King Hall discuss and project on topics like earnings, inflation, yield curve and market direction in this appearance on Yahoo Finance.

Mish reviews her first-quarter trades in this appearance on Business First AM.

Mish talks women in the trading space and covers a wide variety of ideas in this interview for FreeFX.

Mish runs through bonds, modern family, commodities ahead of PCE on Benzinga.

Coming Up:

July 21: BNN Bloomberg

ETF Summary

S&P 500 (SPY): 450 pivotal area failed 440 support.Russell 2000 (IWM): 193 is the 23-month holy grail.Dow (DIA): 34,000 pivotal.Nasdaq (QQQ): Great weekly close, so IWM will definitely be key.Regional banks (KRE): 42.00-44.00 range.Semiconductors (SMH): Where Goliath goes, so do semis — another potential reversal top.Transportation (IYT): Under 250, some trouble.Biotechnology (IBB): 121-130 range.Retail (XRT): 65.00 key support for this coming week.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education